Take a note:

Algorithmic trading, also known as algo trading or automated trading, is a method of trading financial assets using computer programs that execute trades based on predefined instructions. Algo trading can be used to execute trades on a variety of financial assets, including stocks, options, futures, currencies, and commodities.

Key outputs:

– Algorithmic trading has become increasingly popular over the past few decades, as technology has improved and the financial markets have become more complex.

– The primary objective of algorithmic trading is to increase efficiency and reduce costs by removing human intervention from the trading process.

– The most common algorithmic trading strategies include momentum and trend-following strategies, arbitrage opportunities and strategies, index fund rebalancing algorithms, mathematical model-based strategies, mean reversion and trading range algorithms, and advanced order execution strategies.

– Grid Capital offers various resources and tools to assist traders in honing their algorithmic trading skills. Our educational materials, customizable trading platforms, expert support, real-time data, and community resources cater to traders of all levels.

Understanding algorithmic trading

The key components of algorithmic trading:

Data: Algorithmic trading relies heavily on data. Traders use a wide range of data sources, including real-time market data, historical price data, news feeds, and economic data, to develop trading strategies.

Trading strategy: A trading strategy is a set of rules that dictate when to buy or sell a financial instrument. Algorithmic traders use quantitative analysis and machine learning techniques to develop and refine trading strategies.

Algorithm: An algorithm is a set of instructions that a computer program follows to execute trades automatically. The algorithm incorporates the trading strategy, data inputs, and risk management rules.

Risk management: Algorithmic trading involves significant risks, including market volatility, execution errors, and technical glitches. Traders use risk management techniques, such as stop-loss orders and position sizing, to manage risk.

Backtesting: Before deploying an algorithm in live trading, traders typically test the algorithm using historical data to assess its performance. Backtesting helps traders identify potential weaknesses and refine the algorithm.

Execution platform: An execution platform is the software that connects traders to financial markets and enables them to execute trades. Algorithmic traders use specialized execution platforms that offer low latency and high reliability.

Monitoring and maintenance: Algorithmic trading requires ongoing monitoring and maintenance to ensure that the algorithm is functioning properly and to make necessary adjustments based on changing market conditions. Traders use a range of monitoring tools, including real-time performance metrics, alerts, and log files, to track the algorithm’s performance.

How it works

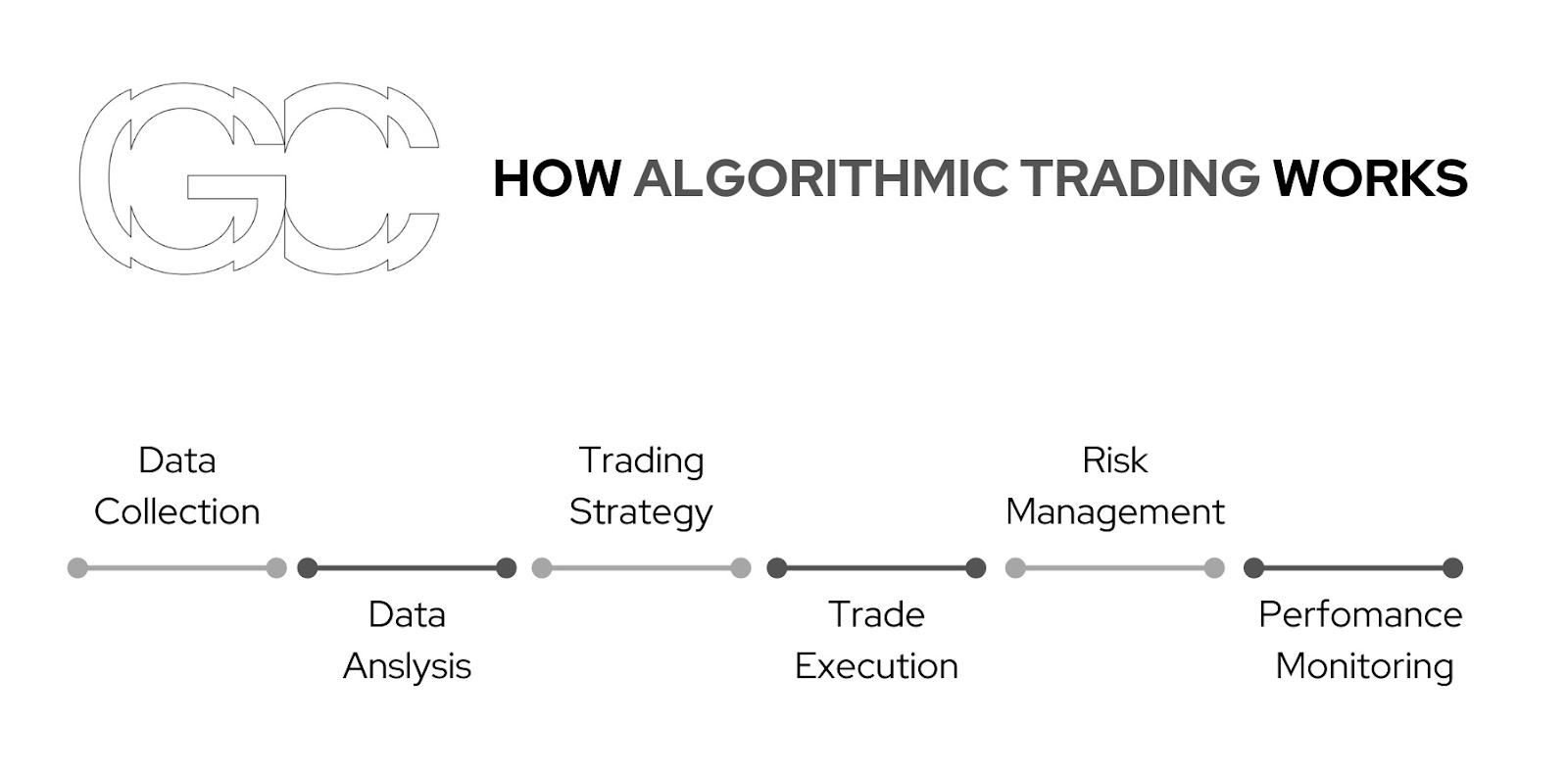

The working process of every Algo Trading includes several steps shown below:

Algo trading algorithms collect market data from various sources, such as stock exchanges, news feeds, and economic indicators. This data includes information about the price, volume, and liquidity of financial assets. The algorithms use mathematical and statistical models to analyze the data and identify patterns and trends.

Based on the analysis of the market data, the algo trading algorithm generates a trading strategy.

Once the algorithm identifies a trading opportunity, it automatically executes a trade based on the pre-defined instructions.

Algo trading algorithms also include risk management parameters, such as maximum loss limits, to minimize potential losses.

Finally, algo trading algorithms continuously monitor their performance and adjust their strategies accordingly. The algorithm can analyze its trading history and identify areas where it can improve its performance.

Advantages and disadvantages of algo trading

Here are some of the advantages and disadvantages of algorithmic trading. Let’s start with the advantages:

Speed: Algorithmic trading can execute trades faster than a human trader. It can analyze data, identify opportunities, and execute trades in milliseconds, reducing the impact of market movements and increasing the potential for profits.

Accuracy: Algorithms can be designed to make complex calculations, consider multiple variables, and make decisions based on data analysis, without being influenced by emotions or biases. This can lead to more accurate and profitable trades.

Efficiency: Algorithmic trading can operate 24/7, monitoring markets and executing trades automatically, freeing up human traders from having to constantly monitor the markets.

Backtesting: Algorithms can be tested on historical data to evaluate their effectiveness, identify weaknesses, and optimize their performance. This can help improve the accuracy and profitability of the algorithm.

The disadvantages are:

Dependence on technology: Algorithmic trading relies on technology to function. Any glitch or malfunction in the system can lead to significant losses, which can be difficult to recover.

Lack of flexibility: Algorithms are designed to operate within a specific set of rules and parameters. If market conditions change, the algorithm may not be able to adapt quickly, potentially leading to losses.

Market impact: High-frequency trading algorithms can cause market volatility and disrupt price discovery, leading to market distortions and potential risks to market stability.

Complexity: Developing and maintaining an algorithmic trading system requires specialized knowledge, expertise, and resources, which can be costly and time-consuming.

Algorithmic trading offers several advantages, including speed, accuracy, efficiency, and backtesting capabilities. However, it also has some drawbacks, including dependence on technology, lack of flexibility, market impact, and complexity. Ultimately, the decision to use algorithmic trading should be based on a thorough understanding of its benefits and risks and the specific needs and goals of the trader.

Algorithmic trading strategies supported by a software

Momentum and trend-following strategies are based on the idea that securities that have performed well in the past will continue to perform well in the future. The algorithm identifies trends and buys or sells assets based on whether the trend is bullish or bearish. These strategies work well in trending markets and can be used for short-term as well as long-term trading.

Arbitrage is the practice of buying and selling the same asset in different markets to take advantage of price differences. Algorithmic trading strategies can identify arbitrage opportunities and execute trades in real-time. These strategies require fast execution and a low-latency trading infrastructure, which is why they are typically used by high-frequency traders.

Index funds are designed to track a specific market index, and their holdings are periodically rebalanced to ensure that they match the index’s performance. Algorithmic trading strategies can automate this rebalancing process by buying or selling stocks based on the index’s changes. This reduces the need for manual intervention and helps keep the fund’s holdings in line with the index.

Mathematical model-based strategies use statistical models to analyze market data and identify trading opportunities. These models can take into account a variety of factors, such as historical prices, volume, and news events, to predict future price movements. These strategies can be used for both short-term and long-term trading.

Mean reversion strategies are based on the idea that assets that have deviated from their average price will eventually return to that price. Trading range algorithms, on the other hand, identify assets that are trading within a certain range and buy or sell when the price reaches the upper or lower end of the range. These strategies work well in range-bound markets.

Advanced order execution strategies are designed to minimize the impact of market volatility on trades. These algorithms can split orders into smaller orders and execute them over time to avoid significant price fluctuations. They can also use market data to adjust the timing and size of orders to maximize profits.

Technical requirements for algo trading software

Algorithmic trading software requires a robust technical infrastructure to ensure fast and reliable execution of trades. Here are some of the technical requirements for algorithmic trading software:

Low latency is crucial for algorithmic trading software, as even a few milliseconds of delay can result in significant losses. This requires a high-speed internet connection, low-latency hardware components, and a reliable hosting service that is located near the exchange.

Algorithmic trading software must be available 24/7, as the markets are open around the clock. This requires redundant servers, backup power supplies, and a team of technical experts to ensure that the software is always up and running.

Also, algorithmic trading software must be able to integrate with various data sources, including market data, news feeds, and economic indicators. This requires a robust data management system and real-time data processing capabilities.

A reliable and efficient technical infrastructure provides traders with a competitive edge, enabling them to execute trades quickly and accurately and potentially increase their profits.

Is algorithmic trading legal and ethical?

Algorithmic trading has become increasingly popular among traders and investors due to its speed, efficiency, and potential for profitability. However, as with any new technology, there are concerns about its legality and ethics. In this article, we will discuss the legal and ethical considerations of algorithmic trading.

Algorithmic trading is legal in most countries, including the United States, European Union, and Japan. However, there are several legal considerations that traders and investors should be aware of.

Regulatory Compliance: Algorithmic trading must comply with various regulatory requirements, including those related to market abuse, insider trading, and market manipulation. Traders and investors must ensure that their algorithms comply with these regulations to avoid legal penalties.

Intellectual Property Rights: Algorithms used in algorithmic trading may be subject to intellectual property rights, including copyrights, patents, and trade secrets. Traders and investors must ensure that they have the legal right to use the algorithms they are using.

Data Privacy: Algorithmic trading involves the collection and processing of large amounts of data, including personal data. Traders and investors must comply with data protection regulations to ensure that they are handling personal data legally.

Ethical Implications and Best Practices

While algorithmic trading is legal, there are ethical implications that traders and investors should consider. Here are some best practices to ensure that algorithmic trading is ethical.

Traders and investors must be transparent about their algorithmic trading strategies, including their parameters, inputs, and outputs. This helps to build trust with stakeholders and ensures that the trading is fair and ethical.

Algorithmic trading must be fair to all market participants. Traders and investors must avoid practices that unfairly disadvantage other market participants, such as front-running, spoofing, or flash trading.

Traders and investors must use algorithmic trading responsibly, taking into account the potential impact on the market and society as a whole. This includes avoiding high-frequency trading strategies that can lead to market volatility and negative externalities.

By adopting best practices in algorithmic trading, traders and investors can help to build trust with stakeholders, ensure the integrity of the market, and potentially increase their profits.

Learning algo trading and software utilization

Algo trading is a complex subject, but there are several resources available that can help you learn about it. Here are some of the best resources:

– There are several books on algorithmic trading that provide an in-depth overview of the subject. Some of the popular books are “Algorithmic Trading: Winning Strategies and Their Rationale” by Ernie Chan, “Quantitative Trading: How to Build Your Own Algorithmic Trading Business” by Dr. Ernest P. Chan, and “Machine Trading: Deploying Computer Algorithms to Conquer the Markets” by Ernest Chan.

– Online courses provide a structured approach to learning algorithmic trading. Here are some of them: “Algorithmic Trading Strategies” by Udemy, “Quantitative Finance and Algorithmic Trading Specialization” by Coursera, and “Algorithmic Trading in Python” by DataCamp.

– Trading forums can be a great resource for algorithmic trading, as they allow traders and investors to share their experiences and strategies. Such forums are Elite Trader, Trade2Win, and Forex Factory.

– Blogs and Websites to immerse yourself into Algo Trading: Popular blogs include QuantStart, Alpha Architect, and Quantocracy. Popular websites include Quantopian, QuantConnect, and TradingView.

– Webinars and conferences provide opportunities to learn from experts in the field and network with other traders and investors. Some popular webinars and conferences include the Quantitative Finance and Algorithmic Trading Conference, the Automated Trading and Quantitative Finance Conference, and the Algo Trading Summit.

Grid Capital & Algorithmic trading

At Grid Capital, we understand the importance of staying ahead of the curve in the fast-paced world of trading. That’s why we offer a comprehensive suite of tools and resources to help our clients develop the skills they need to succeed in algorithmic trading.

We provide a wide range of educational resources, including articles, webinars, and videos with experts, to help you learn the basics of algorithmic trading. Our educational resources cover topics such as trading platforms, programming languages, and market analysis, and are designed to help traders of all skill levels.

Grid Capital‘s platform is designed with algorithmic trading in mind, which allows traders to easily create and test their own algorithms, as well as backtest and optimize existing algorithms.

Our team of expert traders and developers is always available to provide support and guidance to our clients. Our experts can help you troubleshoot any issues you encounter, as well as provide advice on strategy development and optimization.

We provide real-time market data to help traders make informed decisions when developing their algorithmic trading strategies. Our real-time data feeds cover a wide range of asset classes, including stocks, bonds, futures, and options, and are designed to provide traders with the information they need to make informed decisions.

Whether you’re a beginner or an experienced trader, our educational resources, customizable trading platforms, expert support, real-time data, and community support can help you succeed in the world of algorithmic trading. So why not start developing your skills in algorithmic trading with Grid Capital today?

Immerse yourself in the world of investing — make a step beyond the Grid.