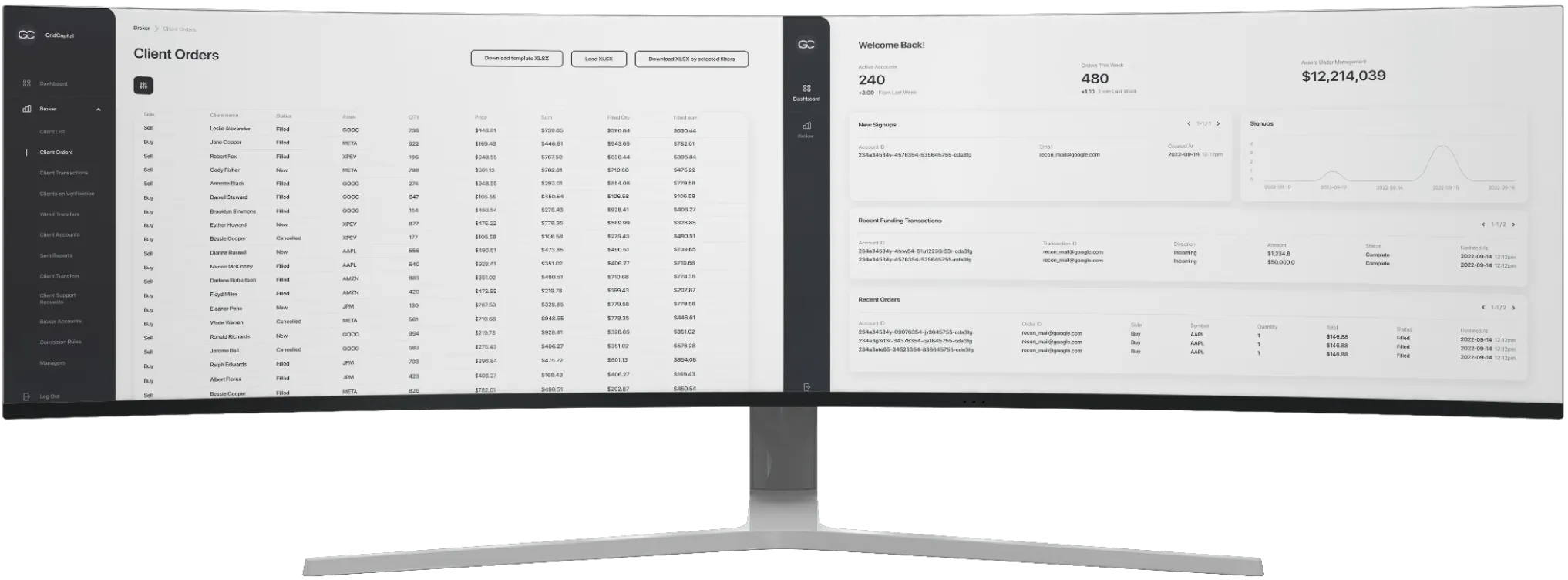

GC CRM specially designed

to take your customer relationships to a new level

Where You Can monitor, interact, implement, impose, control and operate all your processes

Key Features

Client Onboarding, KYC

Data & Users MGMT

Limits & Risks MGMT

Orders / Trades MGMT

Wires & Transfers

Account Management:

The Easy way to manage User Accounts and interact with clients

01

User Settings and Data Management. Manage your client profiles individually or in an organized way

02

Communicate with clients directly thought the app. CRM systems allows to store all the messages so you never forget all your previous conversations

03

All the information about your clients in one place. Gather all the data needed for your compliance and regulatory needs

Positions

View and manage investor positions

Filter down to items of interest

View historic positions for any user

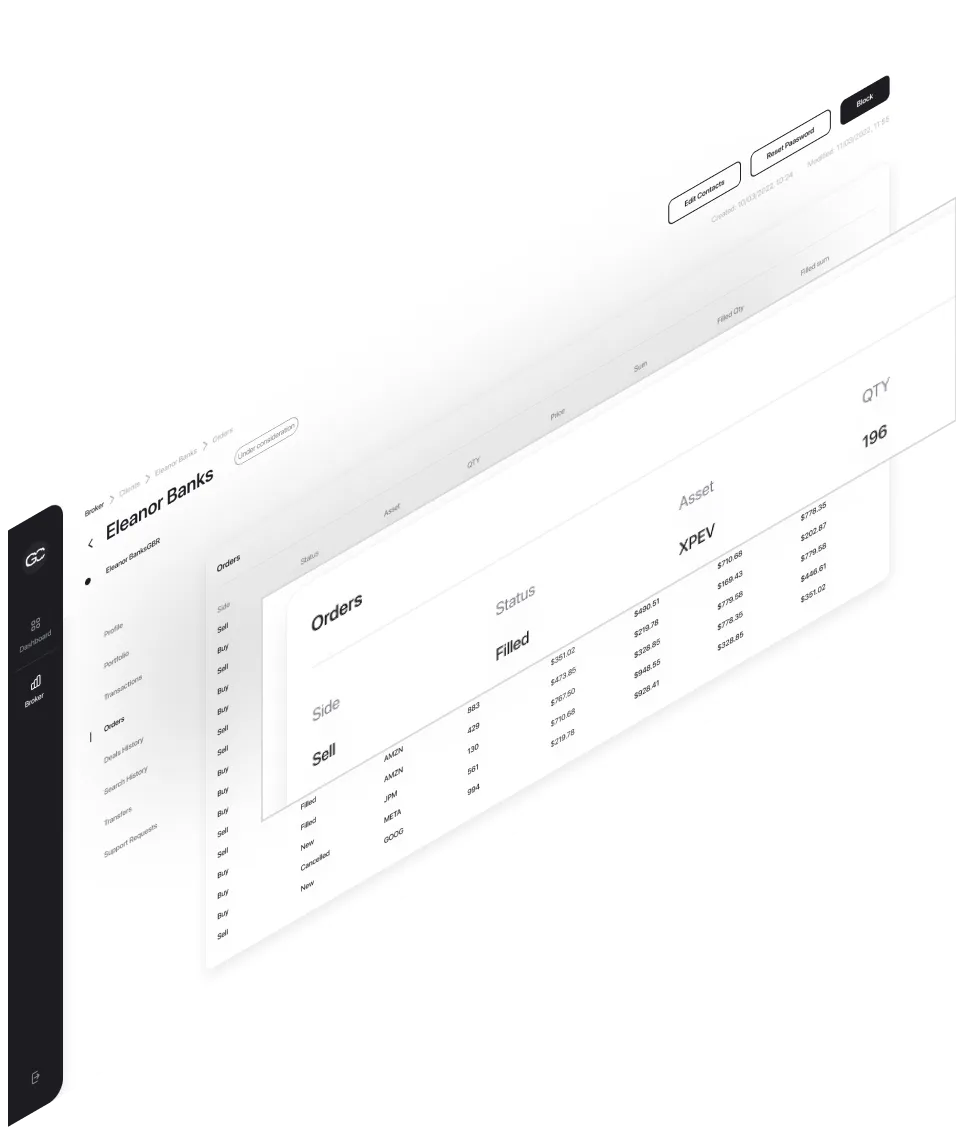

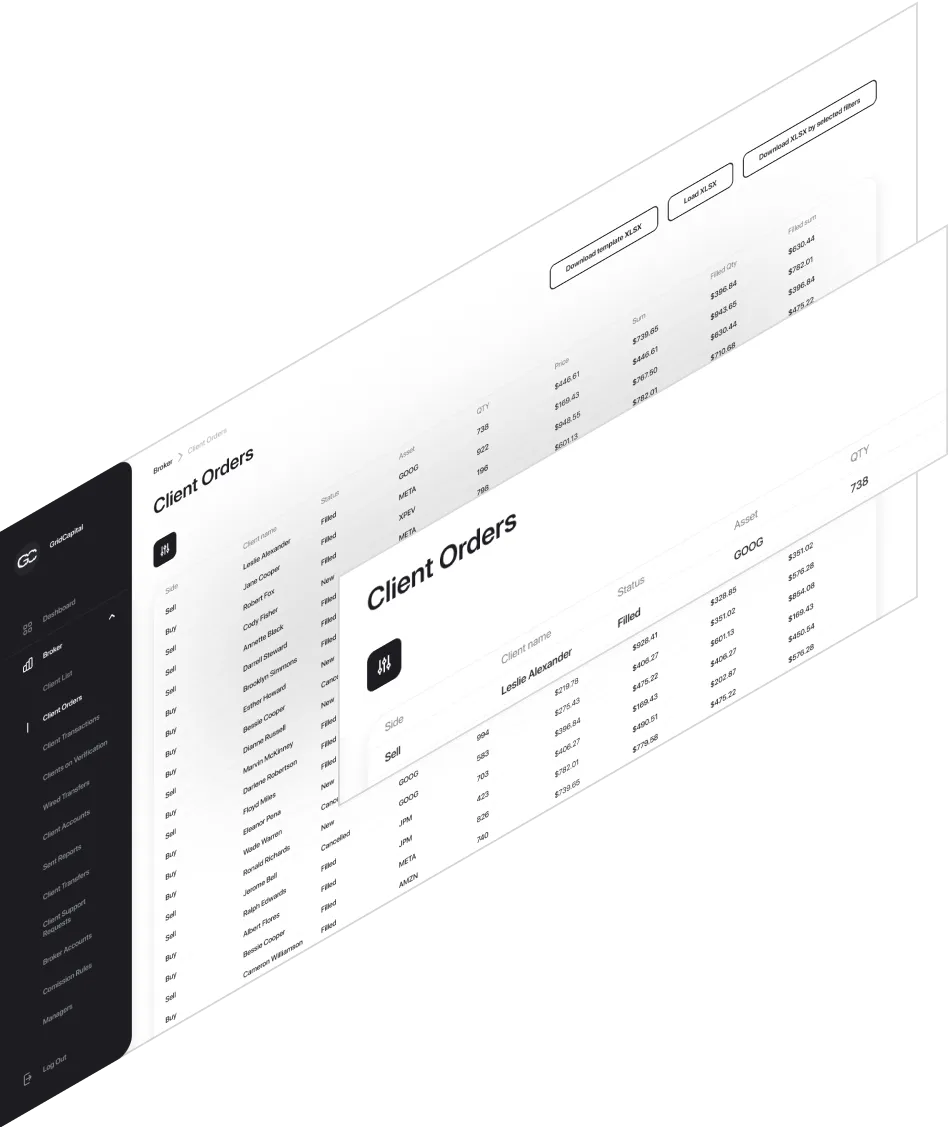

Orders

Orders blotter view, or all orders for individual users

Place or correct orders on behalf of users

Share comments about orders with other back-office admins

User Support

Trading Accounts

Manage multiple trading accounts for each user

Add custom trading rules for individual users or user groups

Margin Trading

Configure margin requirements and rules

Set margin rules for a group or on a per-user basis

Set separate rules for long and short security positions

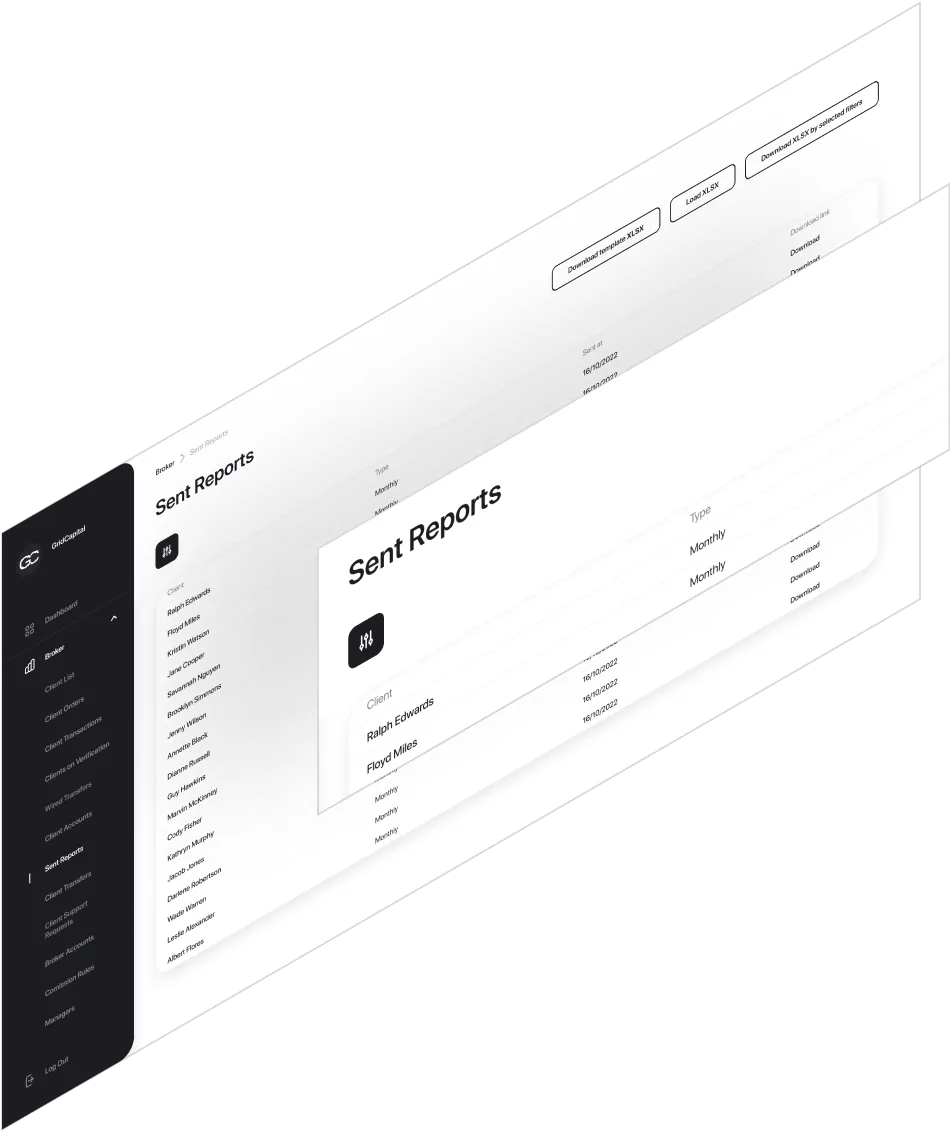

Reporting and compliance

Reporting Engine

Grid Capital Broker Back Office features a built-in reporting engine to automate reporting and compliance work including: regulatory reporting (OATS, CAT) and essential business and financial reports. Reporting engine allows back office specialists to set up new reports and configure existing ones.

Global Compliance

Reduce risks and minimize the chance of human error by automating compliance rules and day-to-day manual operations.

Fat-finger rule warning

Validation engine

Ability to integrate 3rd party background check and validation APIs (KYC)

Market-manipulation scanners.

Risk management

Customizable Alert System

A configurable alert system allows administrators, risk and compliance managers to set up events that trigger alerts in the system, such as approval before users pursue risky trading strategies: global fields change, equity-maintenance call, required-maintenance call, concentrated-maintenance call, day-trade call, house call, split, reverse split, split announcement, reverse-split announcement.

Real-time Margin Calculations

Adjust margins in real time for accurate and agile decision making via broker back office. Real-time calculations and effective notifications system enables broker-dealers to discover potential client trading issues instantly.

Rule Engine

Rule engine reduces errors, upholds compliance and adapts to specifications. Simple to use, it is fully configurable with manual or automatic blocking activity.

Order Processing

Set limits on which securities are tradable, how much can be traded, and even set dollar limits for each individual trade with automatic reject for orders outside of pre-set parameters.

Configuration and operations

Security Master Database

Security Master database simplifies the process of enabling and disabling the the trade of individual securities.

Enable and disable securities system wide, or on a group level

Automatically updated via corporate actions

IPOs automatically pushed to platform

Custom Order Routing

Configure which securities can be traded by a group or an individual

Custom Trading Rules by Security

Create custom margin rates per security

Trading

Create orders via OMS API, GC Trader Web or Broker Back Office.

Trade with any sell-side destination via FIX

Portfolio Monitoring

Hold orders for review before releasing to exchanges and traders

Real-time portfolio analysis

View valuation of portfolios and positions

Drill down to security, position, and transaction details

Analyze and view live and historic P&L

Monitor and track all trading activity on the system

Stock and Options Trading Simulator

Stocks and options trading simulator is the perfect way to open platform to new prospective clients without risk, educate traders and test new models.

Trading API

Take advantage of Our Trading API to enhance the power of GC Trader and diversify services offering. Provide convenient access to brokerage services via modern API. Connect RIAs, digital advisors, FinTech and WealthTech startups to a broker platform within days.

Security

Client confidentiality and data security are imperative to the survival of financial institutions. We design our products with multi-factor authentication, which relies on multiple provisions to verify authorized users. GC’s multi-factor authentication includes:

App-based and SMS 2-factor authentication

Pin Code authentication

Pin Code authentication

Phrase authentication

Using two or more of these authentications together has proven to dramatically decrease the likelihood of a security breach. Additionally, we employ standard security precautions like SSL and HTTPS.