Definition:

Capital gains tax is a compulsory payment that is paid to the government when a person sells an asset (e.g., stock or real estate) for the purpose of making a profit.

What is Capital Gains Tax?

Capital gains tax applies to both individuals and businesses. It is paid when the underlying asset (such as stocks or bonds) is sold and a profit is earned.

In general, capital gains are divided into two categories: short-term and long-term. Short-term capital gains are gains from assets that have been owned for less than one year. Such capital gains are taxed as ordinary income, so the tax rate is generally higher than for long-term capital gains.

Long-term capital gains are taxed more leniently. It represents gain on the sale of an asset that has been owned for more than one year, and depending on your tax bracket, the long-term capital gains tax rate is either 0%, 15%, or 20%.

Capital gains tax rates

Before looking at the tax rates on capital gains, it is important to mention that the tax on both short-term and long-term gains is paid the year after the year of gain.

For instance, five years ago you bought a Manhattan apartment for $1,000,000 to sell it at a higher price a few years later. Then in 2023, you wanted to sell that property for $1,470,000. First, your profit, which would then be taxable, would be $470,000, and second, you would have to pay the tax the next spring, in 2024.

Short-Term Capital Gains Tax

This category includes investors who want to sell their stock or property for a profit but have owned it for one year or less. Such gains from the sale are taxed in the same way as ordinary income.

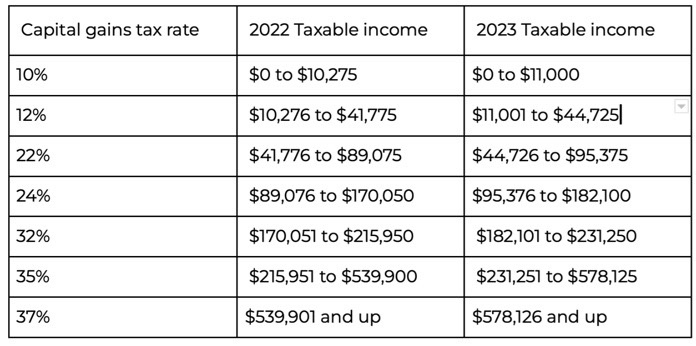

Here you can see the interest rates for corporations in 2022 and 2023:

Long-Term Capital Gains Tax

Another category is long-term investments – if stock or real estate has been owned for more than one year, the tax rate on gains from the sale of these assets can be greatly reduced.

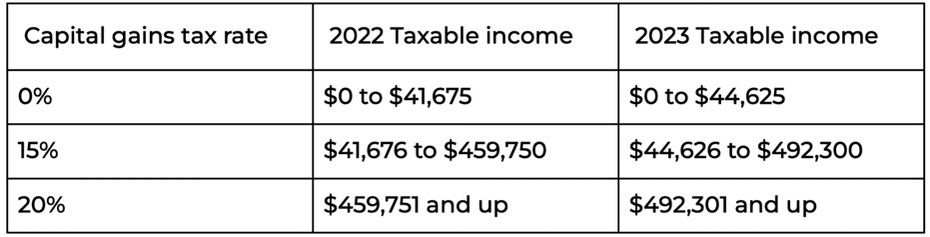

For individuals, the following capital gains tax rates are presented:

Strategies to reduce capital gains tax

– Real estate sales tax

If a single person owns the property and sells it for profit, gains of up to $250,000 are not taxable (if the person is married, the amount doubles to $500,000).

However, this capital gains tax exemption has several exceptions and does not apply if the property owner:

- has not lived in the home (i.e., it is an investment property)

- is living abroad

- has not owned the house and has not lived in it for 2 years during the 5-year period preceding the date of sale.

A homeowner who has already used their $250,000/$500,000 CGT tax credit in the past two years will also not be able to apply for the exemption.

– Gifts

Family gifts can be used to reduce the amount of capital gains tax. A family member can give up to $15,000 each year to another family member as a gift. A married couple can gift up to $30,000 to a relative. So if you gift a valuable asset to a family member who is in a lower tax bracket, together you can minimize the tax burden on your family.

– Keeping

The obvious alternative to paying short-term capital gains tax is to simply keep your investment. Generally, a person’s capital gains tax liability is greatly reduced after a one-year period. Of course, this should be considered in the context of your overall investment strategy.