Definition:

A lien is a legal device for debt securing; it can be used to seize your property if you don’t pay your debt. The object being funded is frequently used as collateral.

What is a Lien?

The majority of liens are caused by debt or borrowing. The most typical sorts are real estate and auto liens, but other times, service providers or your state or federal government may levy them on personal property. If you have a lien placed on your property, the lender or creditor has the legal right to take possession of it if you fail to make your payments on time.

Liens in Mortgage

You most certainly obtained a loan to purchase your home if you’re like other homeowners. Most lenders won’t just assume you’ll repay the loan without checking with you first. Instead, they need collateral to secure the loan, and they can use the house as physical collateral. The bank may force you out of your home and resell it to someone else if you don’t make your loan payments on time.

Up until you have fully repaid the borrowed funds, they continue to have a legal claim on the property. Your use of the property is subject to legal limitations. You can‘t sell it and keep all of the proceeds, nor can you use it as security against a new loan unless the lienholder allows.

Creditor Liens

Liens are commonly employed by other categories of creditors, such as vehicle finance companies, as a legal weapon. The finance company frequently has legal ownership of the vehicle when you purchase it with credit. That finance company has the legal right to legally come and take your automobile away if you don’t make the payments as scheduled.

Tax Liens

Local and federal government agencies employ tax liens as a means of collecting unpaid taxes. These are standard methods of recovering outstanding property or income taxes. If you haven’t made the necessary tax payments, a tax lien may be put against your real property, including your car, house, boat, or bank account. For instance, if you owe back taxes, the IRS may seize your property and sell it at auction to recover all or a portion of the money you owe them.

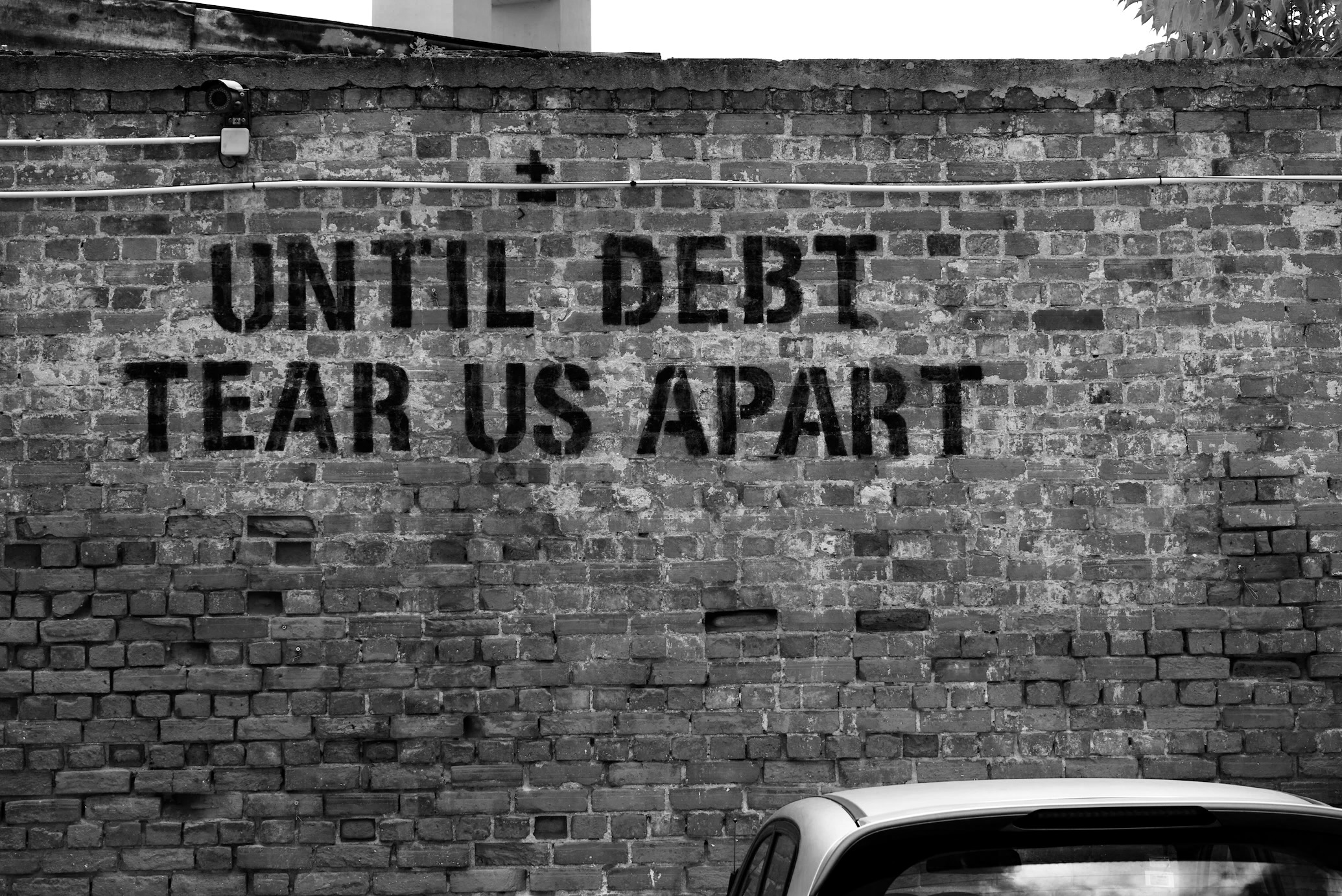

Consequences of having a Lien

On a piece of property that has been financed through borrowing, a lien is typical. A lien is immediately created as a measure to secure the financing because few people buy homes or new cars outright. Such secured collateral liens are entirely common and are not regarded as bad.

Yet, liens that are imposed as a result of unpaid taxes or other debts are frequently viewed negatively. Legal precedent usually favors tax liens. This means that if a property is seized and sold at auction, the back taxes must be paid first out of the net earnings.

How to get rid of a lien

Paying off the debt that caused the lien is the best way to remove it. If you financed a car or a house, make sure you pay off the loan completely. If you need the lien removed in order to legally sell the property in question, you may be able to sell it and use the proceeds to pay off the remainder of the loan, then keep the difference. Speak with your lender about these options.

You can remove liens caused by tax obligations or other creditors by paying off the bill that prompted the lender to levy a lien against you.

If you are unable to pay it in full, you should contact the lender directly and negotiate repayment terms. Some liens expire in due course if they are subject to a statute of limitations. You may be able to simply wait it out in those cases.