The first ETFs for bitcoin have been approved in the USA. The approval of exchange-traded funds for the first cryptocurrency was an important event for the market. Grid Capital analysts will tell you how bitcoin ETFs work and how their appearance will affect the prices of crypto assets.

The approval of the first bitcoin-based exchange-traded funds (ETFs) in the United States signifies a crucial development for the market. This regulatory decision by the Securities and Exchange Commission (SEC) opens up the opportunity for a broad range of investors to trade shares linked to cryptocurrency, providing a new avenue for capital in the crypto market.

Many years of trying

After more than a decade of waiting, the SEC has granted approval for ETFs tied to bitcoin, enabling investors to engage in cryptocurrency trading without directly handling the digital assets. Exchange-traded funds have gained popularity due to their convenience and diverse investment options, allowing investors to trade baskets of assets like stocks on traditional stock exchanges.

Despite previous rejections, the recent approval reflects a shift in the SEC’s stance, influenced in part by a legal battle involving Grayscale, a major player in the cryptocurrency space. Grayscale’s successful lawsuit against the SEC in 2022 challenged the denial of spot bitcoin funds, and this victory is considered a turning point in the regulatory landscape, leading to the recent approval of bitcoin ETFs.

Several prominent entities, including BlackRock, Fidelity, Franklin Templeton, ARK Invest, Grayscale, Hashdex, and Valkyrie, have received approval to launch ETFs, vying for the position of pioneers in the bitcoin ETF market. The infrastructure supporting these ETFs involves major players like Coinbase, which provides bitcoin storage, and market makers such as Jane Street and Virtu.

Custodial custody, a crucial aspect of the process, ensures the secure storage of billions of dollars worth of bitcoins, protecting them from loss, theft, or cyber attacks. The entry of spot ETFs into the American market necessitates monitoring the influx of capital and observing which among the 11 approved issuers captures the largest market share.

Digital Gold

This development is expected to democratize access to cryptocurrency investments, similar to the impact of gold ETFs in making gold investments more accessible. Institutional investors, previously limited in their ability to invest directly in cryptocurrency, can now participate in the market through regulated ETFs, mitigating the challenges associated with storing and trading digital assets.

Drawing parallels with the trajectory of gold ETFs (the first ETFs for gold appeared 20 years ago, and since then the metal has quadrupled in price), analysts from Standard Chartered Bank predict a significant rise in the price of bitcoin following the approval of spot ETFs in the United States. They anticipate a price surge to $100,000 by the end of 2024, projecting a shorter timeframe for this growth compared to the historical performance of gold.

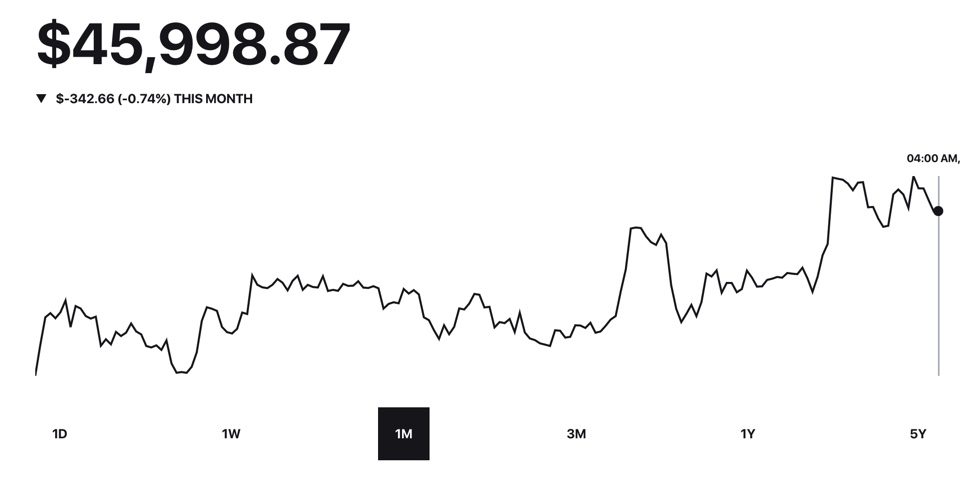

In 2023, bitcoin soared in price by more than 150%. A significant part of this growth followed BlackRock’s June application to create an ETF — before that, bitcoin was trading at around $25 thousand.

At the time of publication of this material, the exchange rate of the first cryptocurrency is at the level of $46 thousand.