Introduction

In the ever-evolving landscape of financial markets, technology has played a pivotal role in reshaping the way traders and investors execute their strategies. One of the most significant technological advancements in recent years is the development and proliferation of automated trading software. Automated trading, often referred to as algorithmic trading or simply algo trading, has revolutionized the way financial instruments are bought and sold.

This article provides a comprehensive overview of automated trading software, its underlying technology, advantages, drawbacks, and a detailed review of GridCapital, a leading automated trading software platform in 2023.

Definition of Automated Trading Software

Automated trading software refers to a computer program or set of algorithms that execute trading decisions on behalf of traders or investors. These algorithms are designed to analyze market data, identify trading opportunities, and execute trades automatically without the need for manual intervention.

In essence, automated trading software enables traders to implement their trading strategies in an efficient and systematic manner.

Significance in the Trading World

The significance of automated trading software in the trading world cannot be overstated. It has brought about a paradigm shift in how financial markets operate. Here are some key aspects that highlight its significance:

Speed and Efficiency: Automated trading systems can execute trades in a matter of milliseconds, far faster than any human trader. This speed is critical in markets where price changes can happen in the blink of an eye.

Elimination of Emotional Biases: Human traders are susceptible to emotional biases such as fear and greed, which can lead to irrational decisions. Automated trading systems operate based on predefined algorithms, eliminating these emotional biases.

Backtesting and Optimization: Automated trading software allows traders to backtest their strategies using historical data, enabling them to fine-tune their approaches and optimize their trading performance.

Diversification: Automated trading systems can manage multiple trading strategies across various asset classes simultaneously, providing traders with a level of diversification that would be challenging to achieve manually.

24/7 Trading: These systems can operate around the clock, taking advantage of global markets and reacting to news and events as they unfold, even when the trader is asleep.

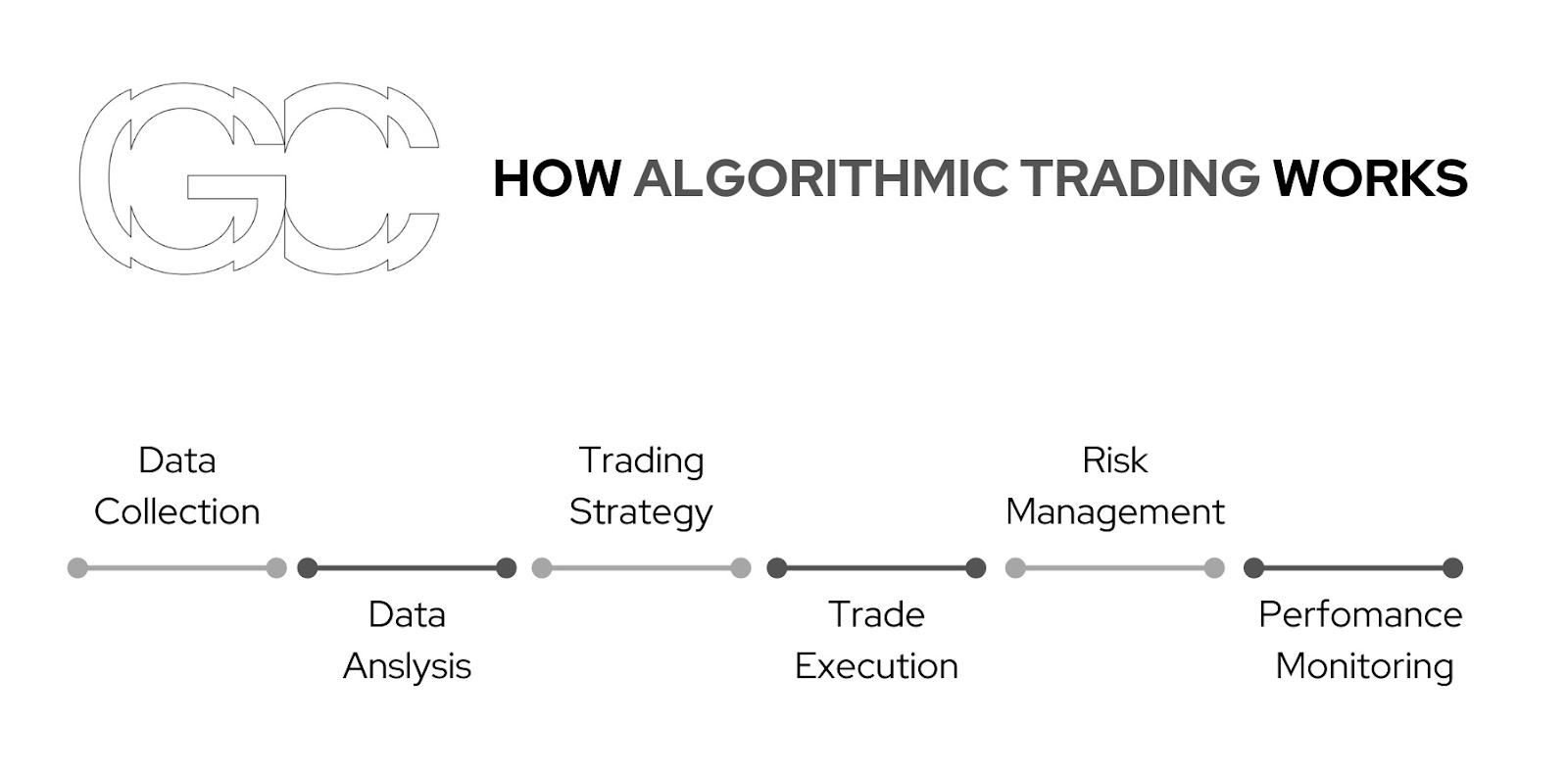

How Automated Trading Works

At the core of automated trading software are complex algorithms and sophisticated technology infrastructure. Here’s an overview of the underlying technology:

Data Gathering: Automated trading systems gather vast amounts of market data in real-time. This data includes price quotes, volume, order book depth, news feeds, and more. Data sources can vary but often include stock exchanges, futures markets, forex markets, and news agencies.

Algorithmic Analysis: Algorithms are used to process the incoming data and make trading decisions. These algorithms can be as simple as moving averages or as complex as machine learning models that analyze multiple factors simultaneously.

Risk Management: Before executing a trade, automated trading systems incorporate risk management rules. These rules define parameters like position size, stop-loss levels, and profit targets to control potential losses.

Order Execution: Once a trading decision is made, the system generates and sends orders to the appropriate exchange or market. This process is typically done through Application Programming Interfaces (APIs) provided by brokers or directly through electronic trading platforms.

Monitoring and Adaptation: Automated trading systems continuously monitor market conditions and adapt their strategies accordingly. They can respond to changes in volatility, news events, and other factors in real-time.

Process Flow of Automated Trading

The process flow of automated trading can be summarized as follows:

Data Collection: Market data is collected from various sources, including price feeds, news sources, and economic indicators.

Analysis: Algorithms analyze the data to identify trading opportunities based on predefined criteria and strategies.

Decision-Making: The system makes trading decisions, taking into account risk management parameters.

Order Generation: Orders are generated and sent to the relevant exchange or market.

Execution: Orders are executed automatically, and trades are confirmed.

Monitoring: The system continuously monitors positions and market conditions.

Adaptation: Based on real-time data and market conditions, the system may adjust its positions or trading strategies.

Key Components Involved

To better understand how automated trading works, let’s delve into the key components involved:

Trading Algorithms: These are the heart of automated trading. Trading algorithms are sets of rules and mathematical models that dictate when to buy or sell an asset. They can range from simple strategies like moving average crossovers to complex machine learning models.

Data Feeds: Reliable and high-quality data feeds are essential. These feeds provide real-time market data, news, and other relevant information.

Execution Platforms: Automated trading software relies on execution platforms to connect with exchanges and execute orders. Popular execution platforms include MetaTrader, Interactive Brokers, and proprietary trading platforms provided by brokerage firms.

Risk Management Systems: Effective risk management is crucial in automated trading. Risk management systems set limits on the size of trades, stop-loss levels, and other parameters to protect against significant losses.

Backtesting Tools: Traders use backtesting tools to assess the historical performance of their algorithms. This helps in fine-tuning strategies before deploying them in live markets.

Hardware and Connectivity: Fast and reliable hardware, along with low-latency internet connections, are necessary to ensure timely order execution.

Market Access: Automated traders need access to various markets, including stocks, options, futures, forex, and cryptocurrencies. The choice of markets depends on the trader’s strategy and objectives.

Advantages and Drawbacks

While automated trading software offers numerous advantages, it’s important to be aware of the potential risks and drawbacks as well.

Benefits of Automated Trading

Automated trading systems can execute trades faster and more efficiently than human traders, capitalizing on opportunities that may be missed otherwise.

Algorithms follow predefined rules rigorously, eliminating emotional biases and ensuring consistency in trading decisions.

Automated systems can manage multiple trading strategies across different assets simultaneously, spreading risk and potentially increasing returns.

Traders can test their strategies historically, enabling them to refine their approaches and optimize performance.

Also, automated trading systems can operate 24/7, taking advantage of global markets and reacting to news and events as they happen.

Potential Risks and Drawbacks to Consider

Automated systems are susceptible to technical glitches, software bugs, and connectivity issues that can lead to unexpected losses.

Excessive backtesting and optimization can lead to overfitting, where strategies perform well in historical data but poorly in live markets.

Rapidly changing market conditions or unusual events can lead to unexpected losses, as algorithms may struggle to adapt.

Algorithms lack the ability to exercise human judgment, which can be critical in certain situations, especially during extreme market events.

Developing and maintaining automated trading systems can be costly, including expenses for data feeds, execution platforms, and hardware.

Automated trading is subject to regulatory oversight, and changes in regulations can impact trading strategies and operations.

Best Automated Trading Software in 2023

Now that we’ve explored the fundamentals of automated trading, it’s time to delve into an in-depth review of GridCapital, which stands out as one of the top choices for automated trading software in 2023.

GridCapital is a highly regarded automated trading software platform that has gained prominence in the financial industry for its innovative approach to algorithmic trading. Let’s take a closer look at its features, performance, and user feedback.

Features of GridCapital

Machine Learning Algorithms: GridCapital utilizes cutting-edge machine learning algorithms to analyze market data and identify trading opportunities. This advanced technology allows for adaptability in different market conditions.

Diversified Asset Coverage: GridCapital provides access to a wide range of assets, including stocks, options, futures, forex, and cryptocurrencies. This allows traders to create diversified portfolios and implement various strategies.

Risk Management Tools: The platform offers robust risk management tools that enable traders to set stop-loss levels, position size limits, and other risk parameters. This helps protect against significant losses.

Backtesting and Optimization: GridCapital’s backtesting tools allow traders to assess the historical performance of their strategies. This feature is essential for refining trading approaches and improving profitability.

User-Friendly Interface: GridCapital’s user interface is designed with traders in mind, providing an intuitive and user-friendly experience for both novice and experienced users.

Performance of GridCapital

GridCapital has demonstrated impressive performance in various market conditions. Key performance indicators include:

Profitability: Many users have reported consistent profitability when using GridCapital’s algorithms, even in challenging market environments.

Low Latency: GridCapital’s infrastructure is designed for low-latency execution, ensuring that traders can take advantage of fast-moving markets.

Adaptability: The platform’s machine learning algorithms have shown the ability to adapt to changing market conditions, which is crucial for sustained success.

User Feedback on testing GridCapital

User feedback after testing the demo version of Grid Capital is overwhelmingly positive, with traders highlighting the following aspects:

Ease of Use: Users appreciate the platform’s user-friendly interface, which makes it accessible to traders of all skill levels.

Profitability: Many users have reported increased profitability and improved trading results since adopting GridCapital.

Customer Support: GridCapital offers responsive customer support, ensuring that users receive assistance when needed.

Continuous Development: Users have praised GridCapital for its commitment to innovation and continuous improvement, resulting in a cutting-edge trading platform.

Other Prominent Platforms

To provide a comprehensive overview, let’s look on other prominent platforms working with the automated trading software space.

AlgoTrader

AlgoTrader offers a wide range of features, including automated trading strategies, risk management tools, and a customizable trading dashboard.

Performance: AlgoTrader has a strong track record of performance and is well-suited for institutional traders and hedge funds.

User Feedback: Users appreciate AlgoTrader’s reliability and scalability, making it a popular choice for professional traders.

MetaTrader 4 (MT4)

MT4 is a widely used platform known for its extensive library of custom indicators and trading robots. It’s favored by retail traders and brokers.

Performance: MT4 offers low-latency execution and robust backtesting capabilities, but it may not be as suitable for high-frequency trading.

User Feedback: MT4 has a large user base and a strong community of traders who share custom indicators and expert advisors.

Conclusion

In conclusion, automated trading software has revolutionized the way trading is conducted in financial markets. GridCapital, along with its both competitors and partners, offers a range of features and benefits to traders and investors.

By understanding the underlying technology, advantages, drawbacks, and considering user feedback, readers can make informed decisions when choosing an automated trading platform that aligns with their goals and strategies in 2023 and beyond.