EOG Resources, Inc., together with its subsidiaries, explores for, develops, produces, and markets crude oil, and natural gas and natural gas liquids. Its principal producing areas are in New Mexico and Texas in the United States; and the Republic of Trinidad and Tobago. The company was formerly known as Enron Oil & Gas Company. EOG Resources, Inc. was incorporated in 1985 and is headquartered in Houston, Texas.

Preliminary industry analysis

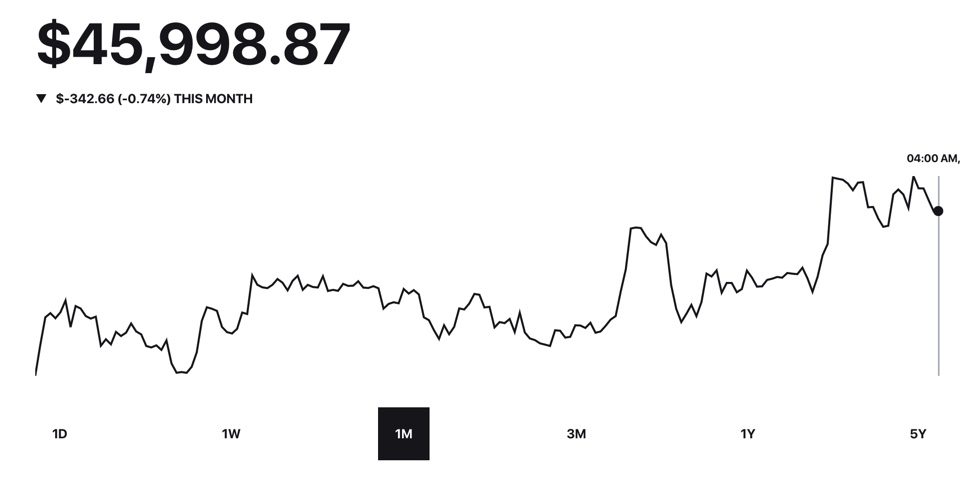

Analysts have revised their fair value estimate for EOG shares, lowering it from $112 to $97 per share. This change is driven by two main factors:

1. firstly, the decline in short-term commodity prices has put pressure on the company’s earnings,

2. secondly, there is a higher cost inflation than expected, which has also negatively impacted the company’s earnings.

In 2023, the company plans to increase capital expenditures by approximately 30%, amounting to $6 billion, compared to the previous forecast of $4.6 billion. This increase largely reflects the increased activity of the company, which, despite a challenging market, aims for moderate growth in production volumes.

The company’s management announces plans to increase oil production by 3% and overall volume by 9% in 2023. To achieve these goals, the company plans to launch two additional drilling rigs and put 80 clean wells into operation at its fields.

Despite this change, the company’s competitiveness will not suffer, as the reduction in the firm’s valuation is due to other factors. EOG’s cost advantage is linked to high-quality areas with a low base, which remains relevant. However, in the next couple of years, the company will need to invest $1-2 billion more than previously anticipated.

Business strategy and prospects

The EOG Corporation is a leading participant in the oil and gas extraction industry, with a primary focus on extracting shale formations in the United States, as well as a small share of operations in Trinidad. The company’s success lies in its ability to identify prospective development areas ahead of competitors, negotiate land leases at attractive prices instead of overpaying for already popular sites. Its recent major deal was its involvement in the Permian Basin project in 2016. Currently, EOG is actively involved in several other shale extraction projects, including Bakken and Eagle Ford.

Additionally, the company has turned its attention to the Powder River Basin and a new gas field in southern Texas called “Dorado”. Like many other companies in the industry, EOG adheres to a capital management policy and aims to return no less than 60% of its annual free cash flow to shareholders through special dividends.

In recent years, EOG has been actively expanding its premium segment, developing new assets, and expanding its operations. Thanks to its scale and diversity, the company has accumulated significant experience in shale extraction, enabling it to quickly adopt new technologies and achieve high production levels.

Initial extraction results at new sites often exceed industry averages, indicating EOG’s high operational efficiency. The company’s size allows it to rely less on external contractors and negotiate more successfully with suppliers during periods of high inflation, ensuring favorable collaboration conditions.

Bull’s opinion

EOG Corporation stands out for its high level of technical equipment in the industry.

The company’s shale well production consistently exceeds market averages.

Instead of engaging in costly mergers and acquisitions, the company leverages its expertise in geological exploration to identify new promising sites before other players enter the game and start driving up land prices.

Owning assets in various basins allows the company to reallocate capital according to market conditions, prioritizing oil or gas production volumes as needed and avoiding areas with excessively high drilling costs.

Bear’s opinion

In 10-15 years, EOG Corporation’s reserves may be depleted if the company fails to find new drilling sites.

Instead of using a more transparent and predictable method, EOG prefers to pay special dividends to shareholders to return excess funds.

The scale of EOG’s operations is a double-edged problem; the company is forced to exert more effort to maintain its production base and drilling rig inventory.